2024 Tax Deadlines & Rates

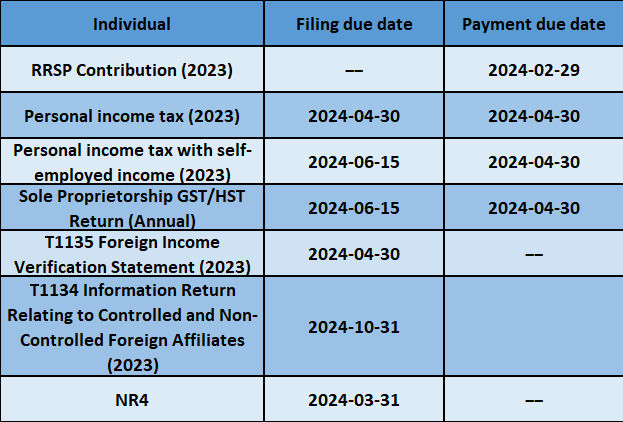

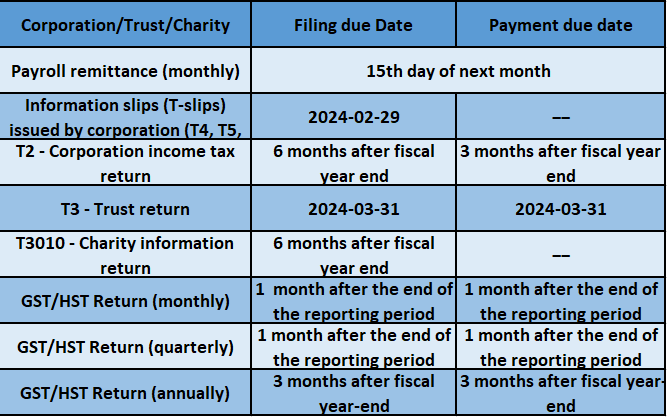

Important Deadlines

Rates

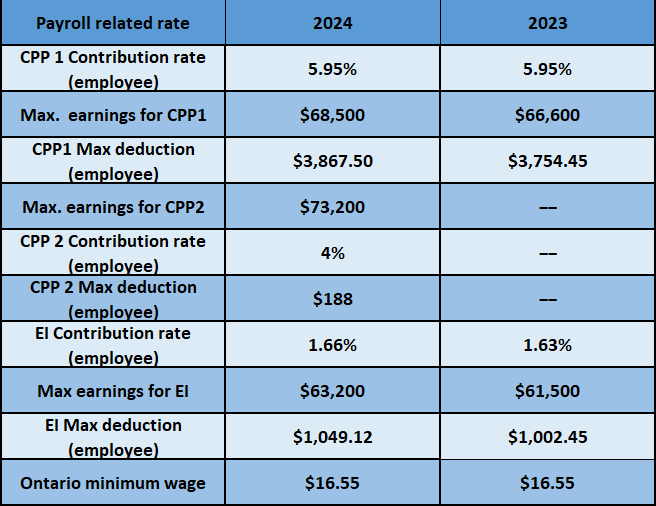

2024 Ontario Payroll Rates

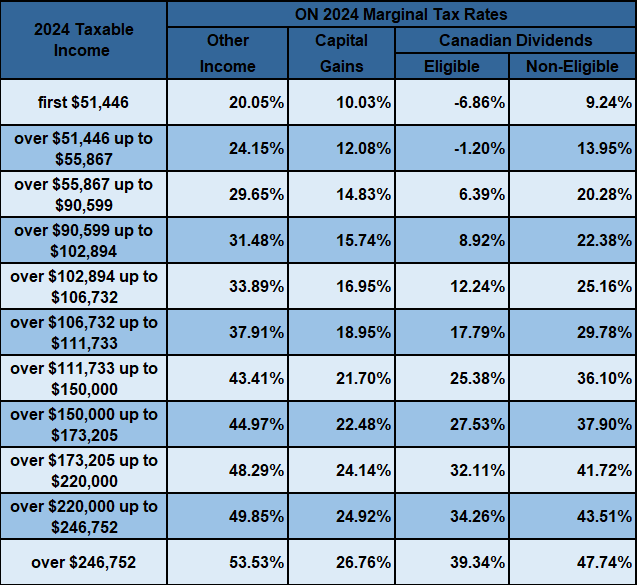

2024 Combined Personal Federal & Ontario Tax Brackets

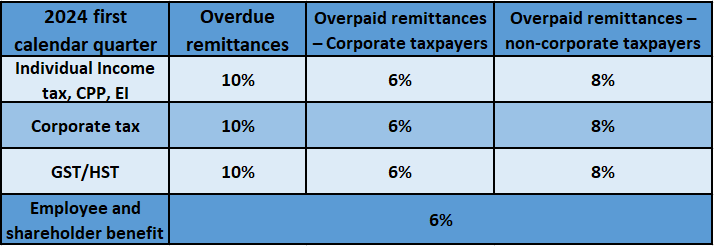

2024 CRA Interest rates for the first calendar quarter

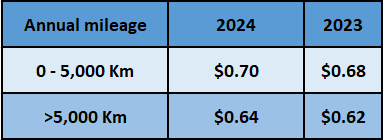

2024 Federal automobile mileage and deduction rates

( In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometer allowed for travel. )

The ceiling for capital cost allowances (CCA) for Class 10.1 passenger vehicles will increase to $37,000, before tax, in respect of new and used vehicles acquired on or after January 1, 2024.

The CCA ceiling for Class 54 zero-emission passenger vehicles ($61,000 before tax for new and used vehicles) will remain the same for 2024, as this limit continues to be appropriate.

The limit on deductible leasing costs will be increased to $1,050 per month, before tax, for new leases entered on or after January 1, 2024.

The maximum allowable interest deduction will be increased to $350 per month for new automobile loans entered on or after January 1, 2024.

2024 New Changes

Eliminating short-term rental deductions

The elimination of some short-term rental deductions is effective on January 1st, 2024.The federal government is now eliminating that tax break, denying operators of short-term rentals any income tax deductions for expenses if they operate in provinces or municipalities that have banned short-term rentals.

The alternative minimum tax for High-Income Individuals (Proposed)

The 2023 federal budget announced significant changes to the alternative minimum tax (AMT) regime to better target the AMT to high‑income individuals. The main proposed change is to increase the federal AMT rate from 15% to 20.5% and the basic exemption amount from $40,000 to the start of the second top federal tax bracket (i.e. approximately $173,205 in 2024; to be indexed annually).

This is article is written only for general information and broad guidance. Please contact our office to discuss about your specific circumstances. We are not responsible for any damage resulting from your reliance on the information in this article.