Home Office Expenses

For the 2020 tax return, employees may be able to deduct home office expenses if you worked at home in 2020 due to COVID-19 provided they meet certain criteria.

Publish at: 2021-03-05

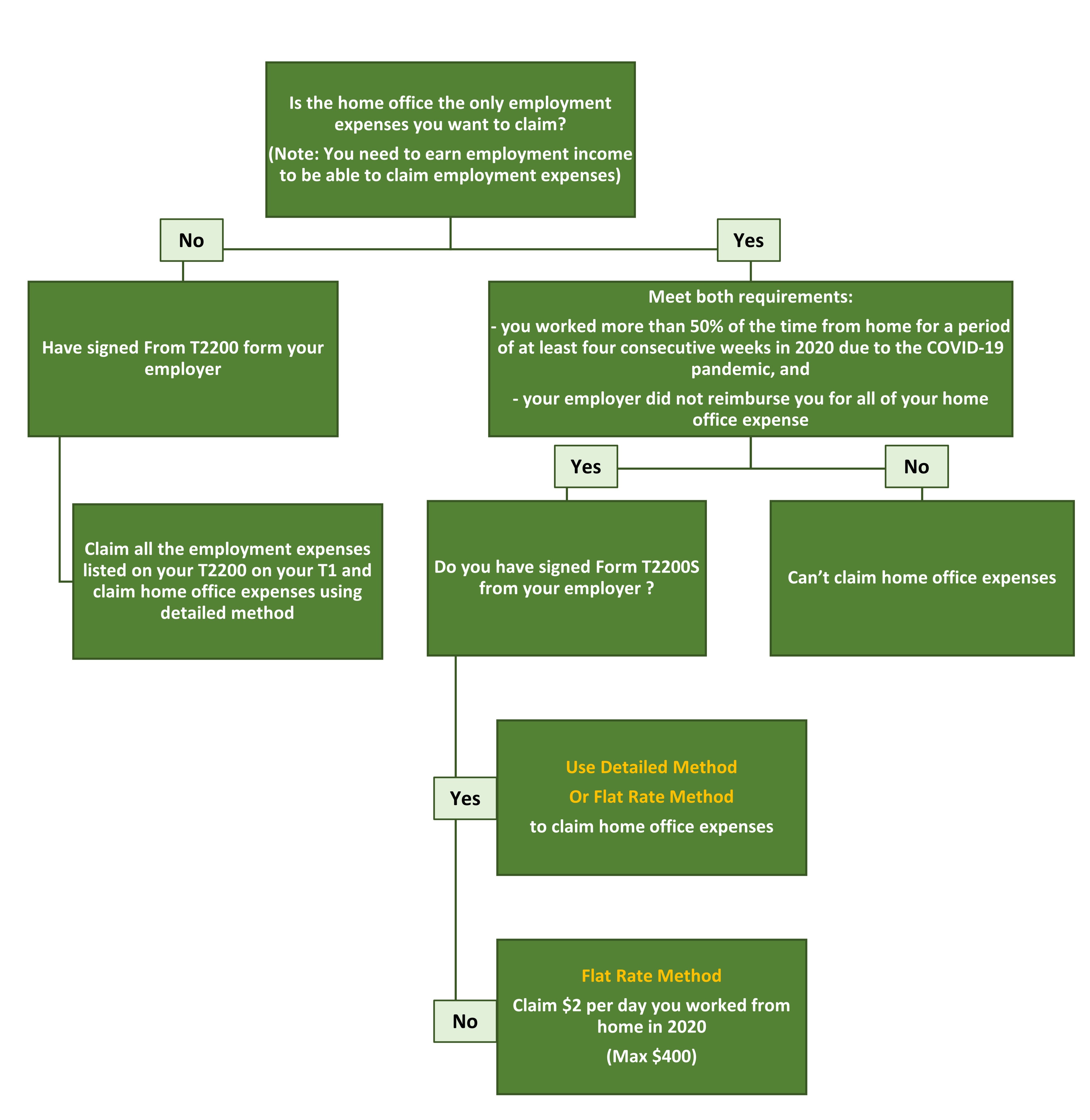

Employees could deduct certain employment expenses on the personal tax return after obtaining a signed Form T2200 from their employers. For the 2020 tax return, employees may be able to deduct home office expenses if you worked at home in 2020 due to COVID-19 provided they meet certain criteria. CRA introduced a simplified method (temporary flat rate fee method) to help taxpayers claim the home office expenses up to $400. It also introduced two new Forms T2200S and T777S related to 2020 employment expenses claims.

Which claim method should I use for home office expenses? And what form should I obtain?

Two different methods are available: temporary flat method and detailed method

Detailed method for home office expenses

Work-space-in-the-home expenses = (% of work space) x (% of time working at home) x (eligible expenses

Please go to the CRA website for detailed information on what can be claimed and cannot be claimed

This is article is written only for general information and broad guidance. Please contact our office to discuss your specific circumstances. We are not responsible for any damage resulting from your reliance on the information in this article.